If you’re here, it means that your company is probably interested in investing in one or more startups.

Prior to making an investment decision, we have to make sure that the opportunity makes sense both strategically (with a validated offering along with a compelling and competitive go-to-market path) as well as financially.

Here’s then our structured 10-step process to make sure you’re investing in the right venture. Let’s start!

Kickoff considerations.

At the kickoff conversation, make it known that before making a decision, you will run a rapid evaluation track that will, in reality, benefit both parties. For your organization, this means peace of mind and for the venture, it is a valuable validation exercise that builds the relationship!

By following these steps, you’ll show the venture’s what smart capital means to you! Make them understand that you’re putting the ‘smart’ on the table before putting the ‘capital’ on the table. Keep in mind that before you have a formal investment/ actual financial investment, you will be doing a serious investment in time, energy and knowledge by following this guide, before investing with money.

Objectives and strategy.

What’s the goal behind your interest in investing in a venture? Remember, there is a substantial initial investment of time, energy and knowledge way before money is involved, so before diving into the investment evaluation, you need to clearly define the organizational goals and expected outcomes of this process.

This will be the foundation to return to when deciding on the right approach to pursue, that will best deliver on these objectives.

Strenghts of startups useally tackle the weaknesses of large organizations, and viceversa.

Defining your intent will support further decision making in this process and avoid wasting time or resources on potential collaborations that don’t contribute to achieving these objectives.

Strenghts of startups useally tackle the weaknesses of large organizations, and viceversa.

The pitch.

The pitch is a crucial moment to kick-off the formal relationship into evaluating a venture’s potential for investment

It may be tempting to simply have an informal discussion with the founder, however, it is crucial to rather clearly define a date and time for the pitch and keep it formal. In this way, you signal to the team that they have to come prepared, which will set the tone for your collaboration, should you later decide to proceed with the Rapid Investment Evaluation track.

In your pitch briefing, communicate clearly what you expect to see in their pitch. Do encourage them to be creative with it too, but these basics should definitely be covered. While they are pitching, observe their body language, and ask a lot of ‘why’ questions.

You may be tempted to, but try not to give advice yet, mostly ask clarifying questions. For now, simply focus on building the relationship.

Some no-no’s that put us on high alert

Don’t sign an NDA before getting into the more sensitive investment discussions. Only sign an NDA if very detailed IP-sensitive info is shared. Don’t sign an NDA if you’re planning to see multiple competing startups. VC’s don’t sign NDA’s either.

This usually sounds great to investors, but is sometimes actually a disadvantage! Then you’re either too early, or your problem doesn’t have a market. You’re going to have to work hard to educate the market and lay the groundwork for your following competitors.

It is okay to be the 2nd, 3rd, 4th or 5th. Just make sure there’s no dominant player yet.

If they don’t dare to strip down their solution to the bare essentials, there’s probably not enough on offer. Hiding behind feature mania is easy, anyone can put a ring on a monkey 🙂

Big red flag. You should aim to own 100% of a niche of the market, you need to find a focus. Especially in the early days, you need a clear target to aim for, instead of pursuing any direction that ‘could work’.

Throw water in their face at this point, they need a wake-up call. Find out why they think that. Ask if they pitched for anyone else, call their references and ask what they think about that valuation.

Information exchange.

You now have seen the pitch, you’ve identified your venturing goals and you’ve decided to engage in the rapid investment evaluation process with a particular startup. What’s next? The information exchange. In order to start the collaboration off on the right foundation, be sure to ask for enough information you’d need ahead of time – as acquiring this information could often take some time.

- Pitch document

- Business Model

- Team CVs and Organizational chart

- Proof of traction (customer information, sales references, letters of intent etc.)

- Current investment and capital structure

- Financial information (e.g. burn rate €/month)

- Description of all products and services

- Supplier or significant partnerships information

- Legal information

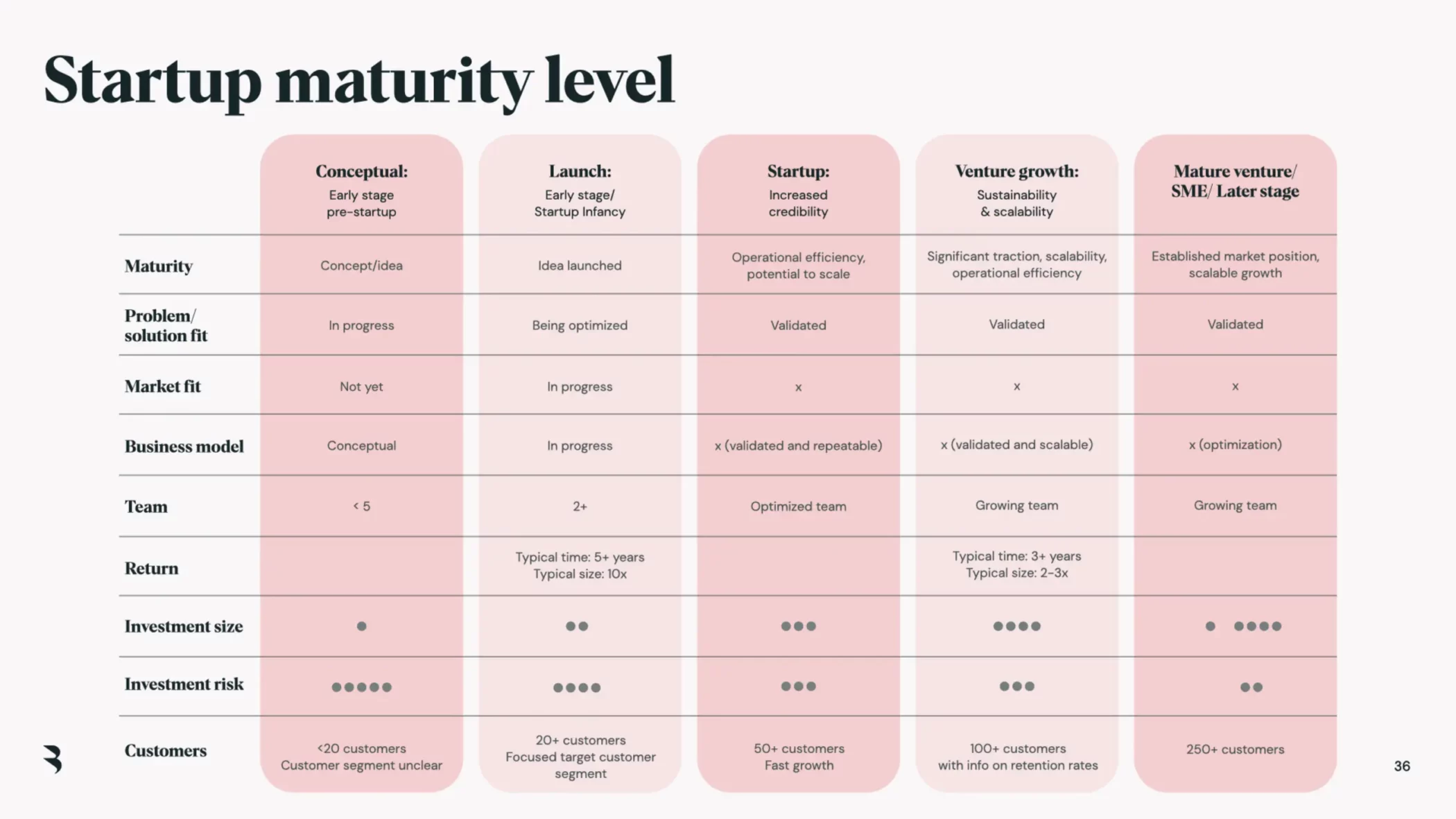

Venture maturity evaluation.

Before spending substantial time and energy in the validation phase of this process, you need to define how much effort will be needed for the Rapid Investment Evaluation by assessing how mature the startup is, which in turn affects how much resources you will have to invest in the venture validation phase.

Ventures at different maturity levels would require a different validation track. Startups are naturally risky, and would consequently need more time spent on validation of various aspects in comparison to Scaleups for instance, that have found a market-fit and are seeking to grow.

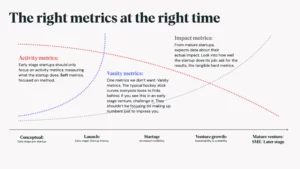

Impact vs. Activity metrics

A venture’s first focus should be learning. Only after a while should it be earning.

If you start focusing on earning, you start by building things right. If you focus on learning, you start by wondering what is the right thing to build. That is the mindset we’re looking for.

Since everyone has read Lean Startup, and no one applies it, we need to objectively measure whether or not that mindset translates to the way the startup is run.

"The only way to win is to learn faster than anyone else." - Eric Ries

Venture validation.

5 aspects of the venture need to be validated ahead of making a decision whether or not to invest.

The amount of time that you’ll spend in this phase depends on the venture maturity. Typically, for an early stage startup, you would spend a substantial amount of time and resources validating whether the problem selected is really worth solving. Once the problem space has been analyzed, your efforts can be focused on determining if the ventures intended solution solves the problem in an effective and in a scalable way.

Venture valuation.

When it’s time to have the Valuation conversation, things could get less than amicable. There is no ‘single right way’ to do this and we would definitely recommend bringing in an expert.

Problem is: while valuing mature companies is fairly straightforward using market capitalization and sales multiples, valuing startups is often more ambiguous and involves not only money, but also energy spent.

However, since these conversations sometimes occur quite spontaneously, we have put together a few pointers to help you keep the discussion in the relationship building realm vs. delving into financials too early.

In the guide, you’ll find the link to 4 common methods of Venture Valuation.

Investment criteria.

After validating the 5 key aspects, you can use this checklist to gauge whether or not you have covered the crucial who, how and what questions.

Final decision.

After validating the 5 key aspects, you can use this checklist to gauge whether or not you have covered the crucial who, how and what questions.

Startup investment guide

10 key steps to follow in order to validate a venture’s potential and justify an offer for investment.

Useful Resources

After validating the 5 key aspects, you can use this checklist to gauge whether or not you have covered the crucial who, how and what questions.

- Validation guide covers how to choose the right experiments to validate elements of a business.

- Questions to ask during a founders pitch.

- Competitor mapping analysis tool to compare companies

- 10 questions we ask founders

- Crunchbase and Mosaic: Discover innovative companies and the people behind them.

- Inspiration from the top 100 venture capitalists.

- How to Pitch to a VC covers what Venture Capitalists usually look for in a pitch for investment

Which strategy will help you stay ahead of the curve?

We can help you translate your growth mission into action by delivering an innovation plan.