Who is this guide for?

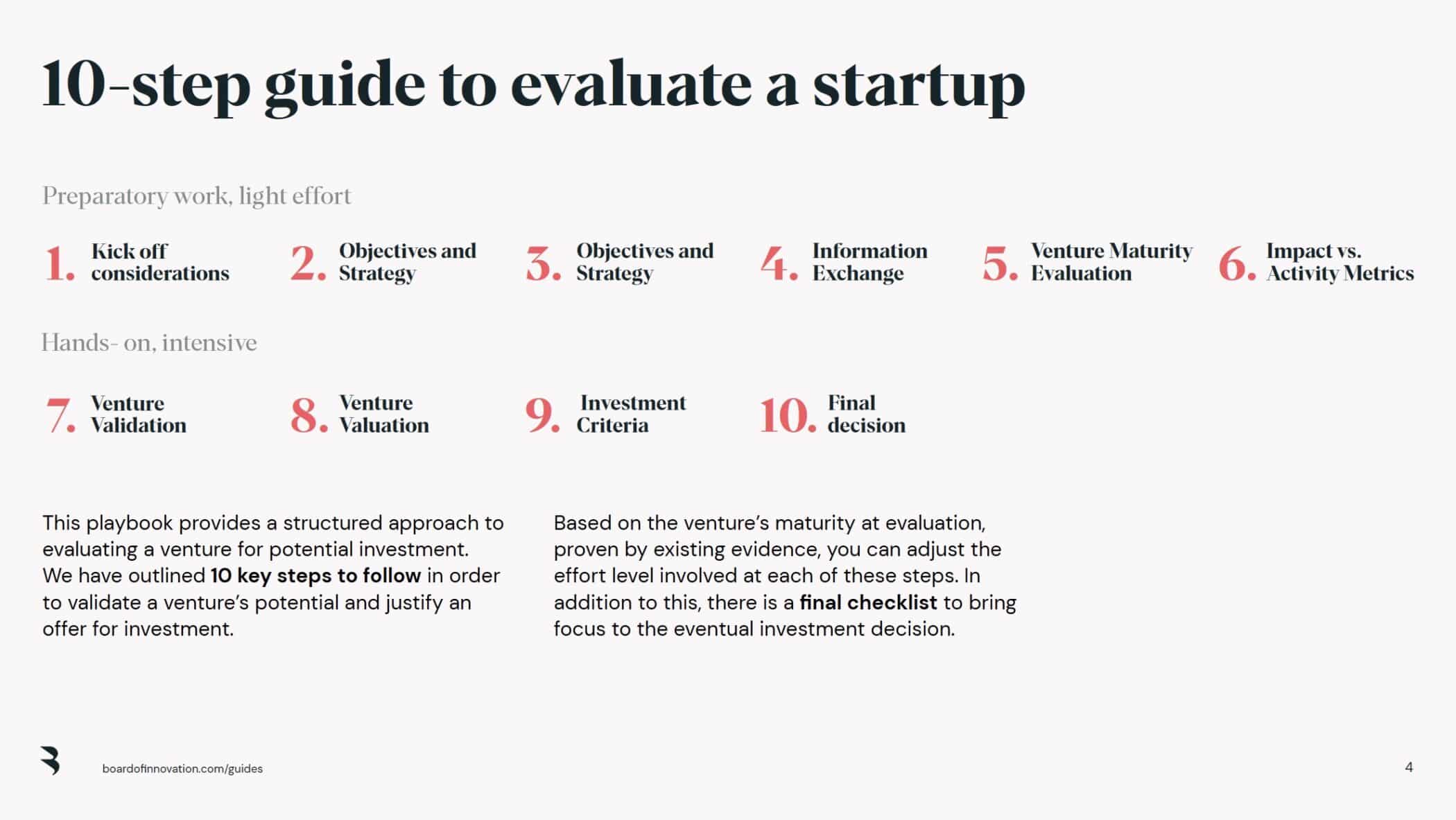

This guide provides a structured approach to evaluate a venture for potential investment.

We have outlined 10 key steps to follow in order to validate a venture’s potential and justify an offer for investment.

Based on the venture’s maturity at evaluation, proven by existing evidence, you can adjust the effort level involved in each of these steps. In addition to this, there is a final checklist to bring focus to the eventual investment decision.

5 examples from this guide

1. How to save a lot of money? Run step 1-6 first (light effort) and keep going only if the startup has successfully passed these 6 steps.

Prior to making an investment decision, we have to make sure that the opportunity makes sense both strategically (with a validated offering along with a compelling and competitive go-to-market path) as well as financially. We, therefore, need to proceed step by step to evaluate the investment opportunity based on validated evidence.

2. Strengths of startups are the weaknesses of corporates and vice-versa.

Collaborations between startups and corporates find their raison d’être in the mutual exchange of know-how and strengths. Here are some examples.

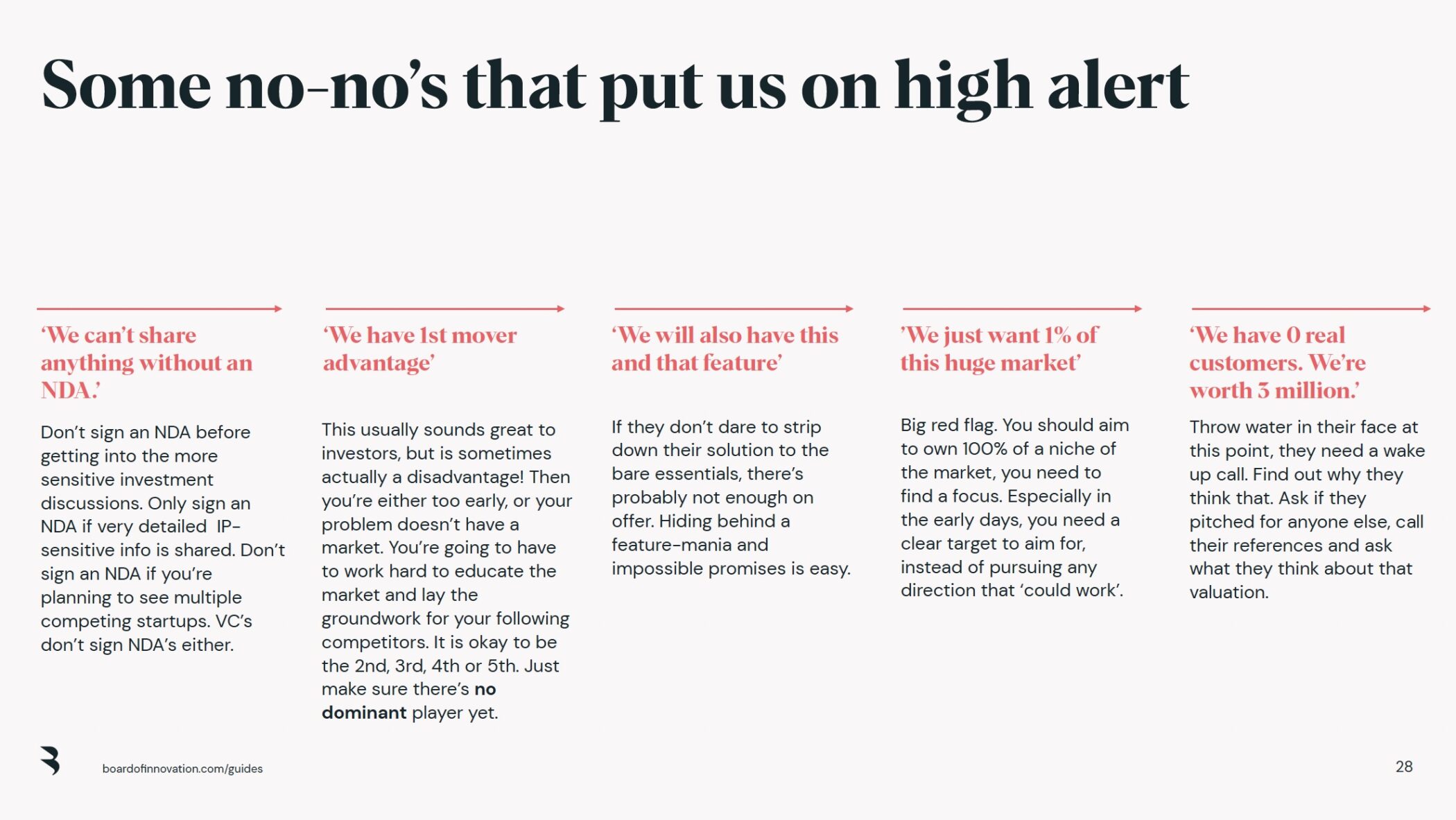

3. Three sentences that may result into an end of the relationship with the startup.

Has the founding team ever pronounced these sentences? If yes, well, figure out what’s behind their reasoning. If strong arguments are missing, it may reflect a scarce experience of the founding team.

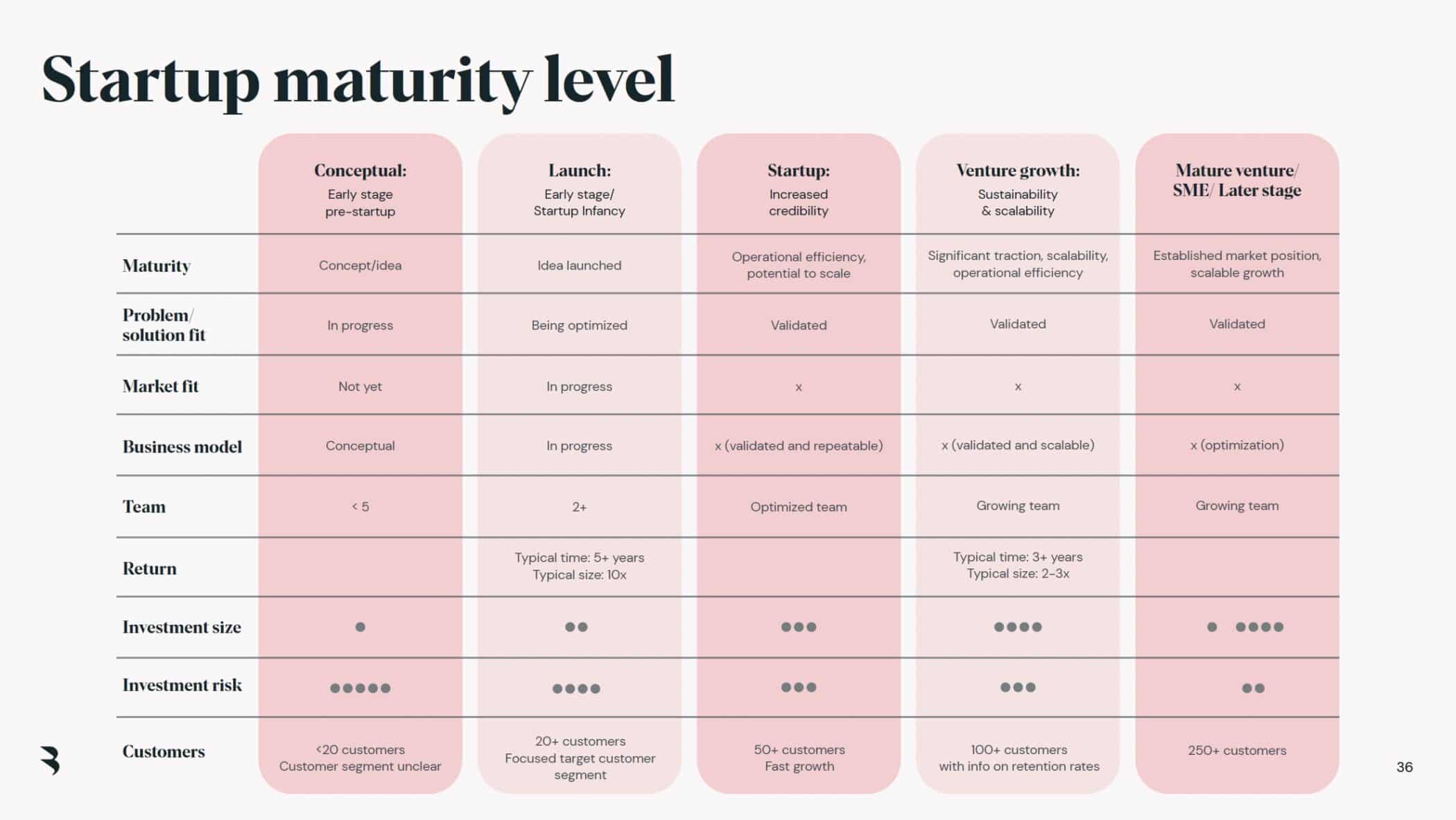

4. Assess the startup maturity level, so that you know what you still need to validate.

Why is it important to assess the maturity of the startup? Because ventures at different maturity levels require a different validation track.

Early-stage startups are naturally risky and need more time spent on validation of various aspects (problem fit and solution fit first and foremost).

On the other side, mature ventures have already found a market-fit, and need to focus on growth instead.

Early-stage startups are naturally risky and need more time spent on validation of various aspects (problem fit and solution fit first and foremost).

On the other side, mature ventures have already found a market-fit, and need to focus on growth instead.

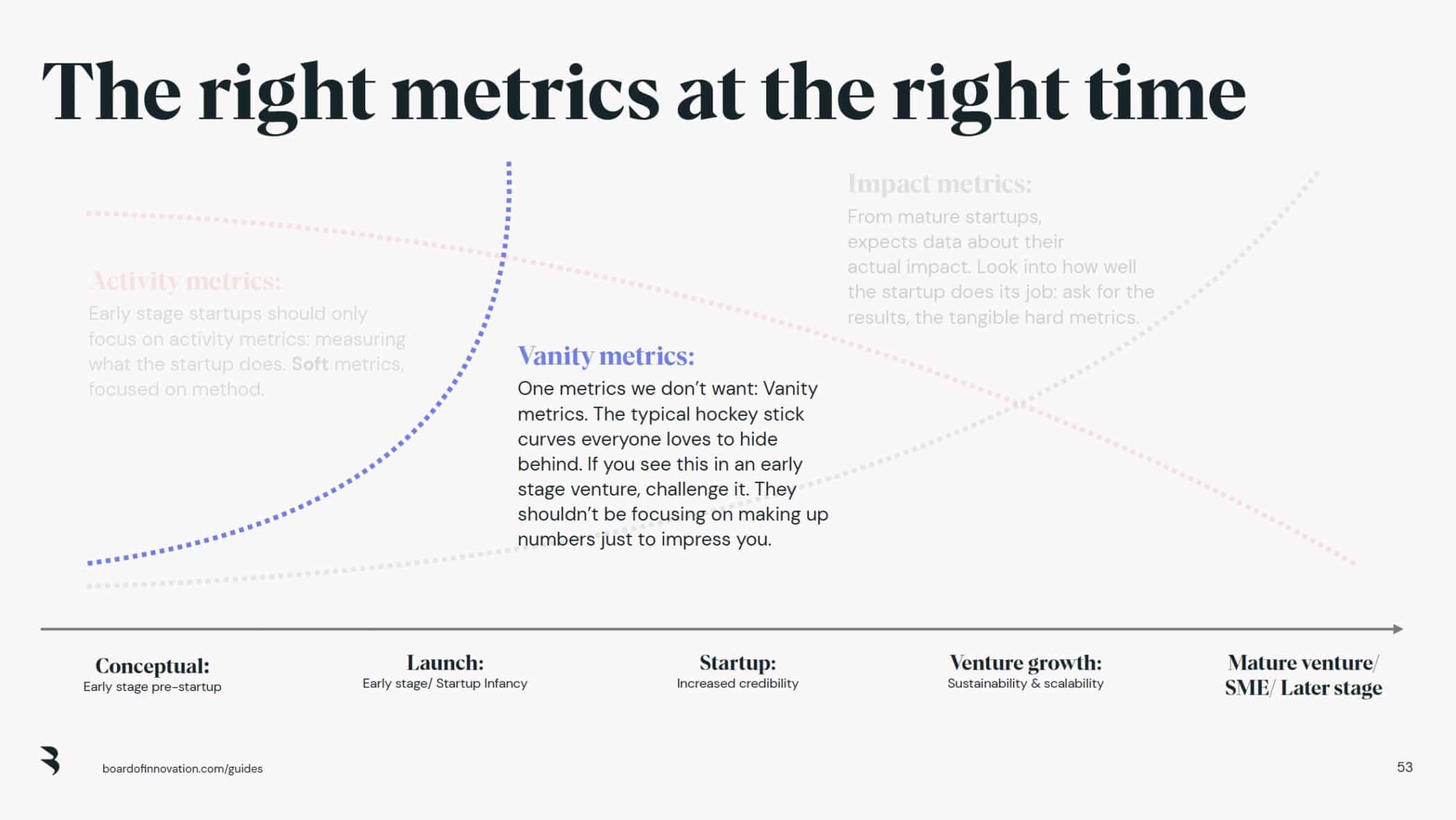

5. Metrics for small startups are dramatically different from the ones you expect from more mature organizations.

Let’s make some concrete examples:

Metrics for early-stage pre-startups (mainly “activity metrics” = “we’re doing our best to figure things out”):

- # of customer interviews

- # of customer problems identified

- 1 clear problem statement selected

- # of experiments

- # of low-fidelity prototypes developed

- % of time spent on non-value adding activities

Metrics for mature startups (time to move to “impact metrics” = “look at the awesome results we achieved”):

- Customer satisfaction

- # of improvements/pivots

- Social media coverage

- Revenue