Tell me more about this case

Let’s talk about what life needs next

ING is one of the world’s leading banks active in financing and hedging physical commodities like crude oil, aluminum, coffee beans and more.

An ambitious CEO and team at ING saw that banking was becoming commoditized by ‘neo banks’ and wanted to leverage ING’s leadership position in commodity trading to become the platform for commodity finance and banking. They spotted an opportunity to leverage blockchain technologies to smoothen international value chains, but didn’t know how to turn this idea into a commercial success.

We guided and worked with ING to define the business model behind the two ventures it wanted to launch. We quantified the cost savings, efficiency gains, and uptake on trade volumes to build the foundations of the business case. We helped define the MVP and small initial set of stakeholders needed to get the business off the ground, and defined the scaling principles needed to let the platform start small, but then quickly scale horizontally (new players) and vertically (new industries).

ING launched two ventures, VAKT and Komgo, which have become the world’s largest multi-bank trade finance platforms. There isn’t public information about the current value of VAKT and Komgo, but based on raising $50-100M in capital to date, we suspect that between the two of them they have achieved unicorn status (value of $1 billion) or will do so soon.

With the growth of online banking and many new "neo-banks", ING, a leading authority in global trade finance, started a journey to change its place in the fast-changing world of finance. Seeing that digitization was becoming more common in all industries, ING planned to be both a supporting platform for traders and the main banking service for them, all the while leveraging its notable 25% share in global commodity trading.

Taking advantage of the game-changing power of blockchain technology, ING wanted to move from old paper-based systems to quicker and simpler digital ones. Driven by ambition, ING's leaders aimed to lead the way in turning banking into a platform-based service. This idea was not just about making things run smoother and reducing compliance and security risks; it was also about positioning ING as the go-to digital platform for commodity finance and banking.

To turn this ambitious vision into reality, ING joined forces with Board of Innovation. Together, we worked hard to rethink the future of global trade, come up with new digital trading solutions, and create the business plan needed to make sure ING succeeded in the market.

Working with ING, we aimed to streamline global commodity trading and logistics infrastructure. Recognizing the inefficiencies in the sector, we proposed a shift to a digital platform, offering significant time and cost savings.

We quantified the sector's issues - delays, errors, and security risks associated with paper-based practices, to justify investment in the area. Through understanding value chain transactions and customer workflows, we validated that digitizing the process would increase efficiency, security, and reduce costs.

Insight from one of ING’s customers

Our role on the team was to champion win-win supply chain solutions and scalability, seeking quick wins to test, learn, and grow. We identified the participation of all stakeholders in the trade finance chain as critical to the business case. We crafted three consortium business models designed to benefit the entire ecosystem, encouraging ING to partner with Société Générale to gain the critical mass needed to overcome market inertia.

However, achieving universal adoption was a challenge. Resisting digital solution by a single player, or reluctance from other banks, would impede its implementation. Our solution was to craft business models benefitting all parties, allowing for quick scalability and critical mass.

From the start, we worked with ING on consortium business models, ensuring value for all parties both horizontally across the value chain and vertically across several industries. Our principle of horizontal integration brought other banks (like Société Générale) on board to get the 50% critical mass of global trade finance transactions and economies of scale needed to conveniently unite stakeholders like warehouses, harbors and shipowners in one platform. We focused the application on the most promising value chains (=verticals) like oil/energy and soy, but in a way that it could easily scale to other value chains upon its success. For this, we brought together founding partners like BP (for oil/energy) and Cargill (for soy). ING is planning to launch 3 more ventures to involve major traders in the equity of their vertical.

Our proposed digital system, tested successfully on a real crude oil cargo shipment, proved its potential for significant time savings and efficiency gains. This secure and private system offered value for everyone on the supply chain.

Arne van Balen, BOI’s Partner and Managing Director for Europe, the Middle East, and Africa

The outcome of our work was securing a scalable, strong business model for ING’s two ventures, VAKT and Komgo. There isn’t public information about the current value of VAKT and Komgo, but we suspect that between the two of them they have achieved unicorn status (value of $1 billion) or will do so soon.

Faster transactions, down from 3 hours to 25 minutes

Increase in trade efficiency

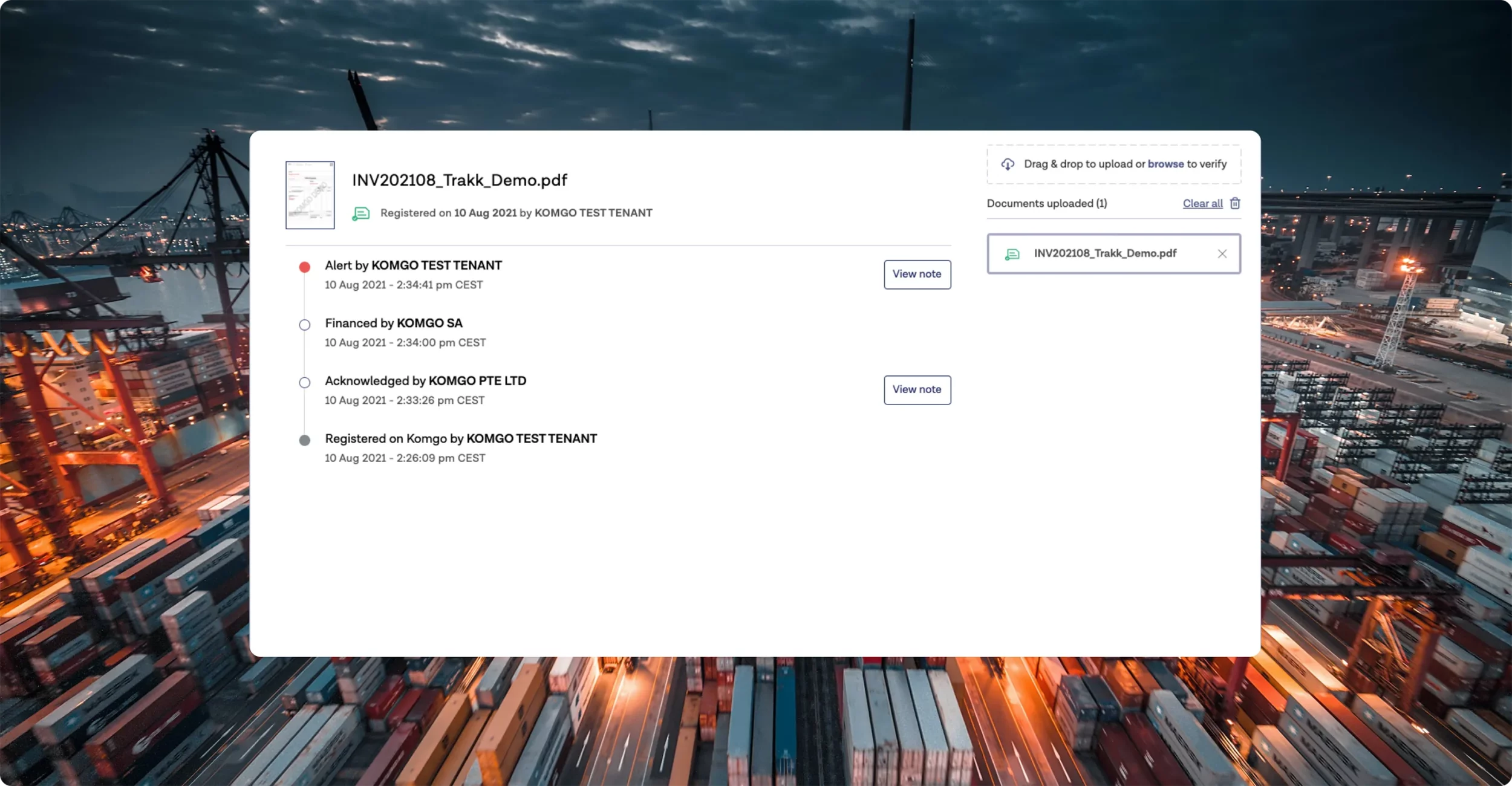

Both ventures also support the elements of ING’s core business that needed more attention and both are succeeding because they are meeting needs of the whole industry and ecosystem. The VAKT platform manages transactions, from trade entry to final settlement, eliminating reconciliation and paper-based processes, and improving security and efficiency for all participants. In December 2019, Komgo processed its first live Letter of Credit, and has already become the world’s largest multi-bank trade finance platform. It digitalizes trade finance and automates finance transactions, allowing banks, traders, and other participants to make transactions in a secure environment. The ventures work together as interoperable platforms, which combined, have transformed the way energy is traded.

The other big win so far has been Komgo, formed by a consortium of 15 of the world’s largest banking and commodity companies (including ING and Société Générale). The inclusion of energy and trading companies as shareholders differentiates Komgo from the other trade finance blockchains that are all solely funded by banks. Based on that same business logic and business model, Komgo intends to expand into agribusiness, steel/ metals and shipping/containers.

Souleïma Baddi, CEO Komgo

The impact of the work we did is that we designed the business model that made change happen quicker in a conservative, lagging industry. Great solutions often die because only half the parties want to adopt them. Our business model (open ecosystem) had designed incentives for each player to join, which made the solution a success. The solution is now on track to becoming a unicorn.

TotalEnergies

Let’s talk about what life needs next