What is inclusive innovation?

In Rwanda, many people are currently living without insurance and only have limited access to formal finance. Paying for traditional insurance premiums is well out of reach. We travelled to the country to help four of the biggest local insurance companies come up with their very first microinsurance products for this target group. We partnered up with Microinsurance Master and Access to Finance Rwanda, a non-profit organization that facilitates and funds innovation projects to improve the livelihoods of the poor. During an intense 2-week program, we guided these pioneers from customer empathy, through ideation and business modelling. We ended with a prototype tested in the field and a business case ready to pitch.

In this article, we’ll share how microinsurance could have a tremendous impact on the country’s poor, while also providing a considerable opportunity for companies willing to enter this market.

If you’re looking to organise an initiative yourself, click on the button below to find out what we did during the 9 days we were in Kigali, along with some handy tips and tricks. That way, you’re well on your way to giving it a try!

Red Ocean vs. Blue Ocean?

The Red Ocean of insurance

In this blog, Bert Opdebeeck from Microinsurance Master points out a painful truth about the Kenyan economy: insurance is in the throes of a bitter price war because competition is limited to the top slice of the market. It’s no different in Rwanda: fourteen companies are competing for over one million customers, a mere 8% of the country’s population.

By contrast, over 90% of the country is excluded from basic insurance products, apart from the basic universal health insurance offered by the government. A quick survey taught us that similar dynamics exist not only for other financial products, but also for other industries in Rwanda and the rest of the East African Community.

Microinsurance: Golden opportunity with a double bottom line

The income streams of the 90% can be characterized as low, unpredictable and irregular. Yet financial setbacks are numerous and frequent. From funeral costs, to hospitalization charges or loss of personal goods, risk is a big part of their lives. The goal of microinsurance is to increase their financial stability. By understanding the risks they face, insurance companies can create an innovative service that is both profitable for the insurer, and affordable for the customer.

We went out into the streets, travelled to tea plantations, and visited ‘agakiriros’ (work spaces for micro-entrepreneurs with the tools and supplies they need to do business) to interview potential customers. Everywhere we went, we heard the same message: people are acutely aware of the risks they face and would jump at the opportunity to get insured if the conditions were right, ie. in their price range, with pay-when-they-can options, and speedy access to much-needed funds. We came to conclusions very similar to Daryl Collins in his book Portfolios of the Poor: People have complex financial portfolios and are eager to find formal alternatives that are more trustworthy, and suited to their lives.

We were on the right track!

The four days leading up to the customer interviews consisted of a deep look at the research that had been gathered to date. All teams had interviewed as many as 97 respondents in one-to-one interviews and focus group discussions. The challenge was to distill the key risks of a typical persona within the target segment. Once this was defined, we were able to get creative and ideate on the ideal solution for them. We also came up with sustainable business models with a healthy profit margin for the companies, and that could be offered at a reasonable rate for the customers.

Business modelling and technology

The things holding back the poor from buying insurance are twofold: the perception that insurance is only for the rich, and the harsh reality that policies are indeed priced in ways that are difficult for them. These are things that can be fixed. Here are the four elements that are needed to achieve the ‘double bottom line’ generating a profit while creating a positive social impact:

Understand the precise needs and the daily lives of the people you are serving. What risks are they most looking to get covered? What are their income and spending patterns? Where, how, and how often do they currently use similar services? What determines whether they trust an alternative over the current informal financial networks that exist?

To reach these people is available, all you need to know is how and when to use it. HCD allows these companies to see exactly how the various forms of microinsurance can fit into their lives. Mobile tech, weather indexes, optical character recognition software for scanning pictures of doctor slips…can these technologies help you?

Which business model should you pursue, and how should you price your service? Due to mechanisms like ‘hyperbolic discounting’, in times of need, 100 euros received immediately can be worth more than 150 received tomorrow. Taking these mechanisms into account often makes it possible to lower benefits, making policies far more affordable (with lower premiums), yet delivering higher perceived value. Here is a similar case.

A business model that tackles this. Can you add flexibility to the way people pay premiums? Can you come up with mechanisms that allow customers to make claims and receive benefits within a few hours?

Are there partnerships that you can leverage? A key strategy in bringing services to market is bundling. It’s tough to get a microinsurance venture off the ground without this strategy. Successful cases are the mobile microinsurance offered by BIMA that adds insurance onto purchases people already make. This not only makes it possible to demonstrate value without selling the products outright, it also creates a stable way of collecting premiums that people seldom drop out of.

Long-term investment

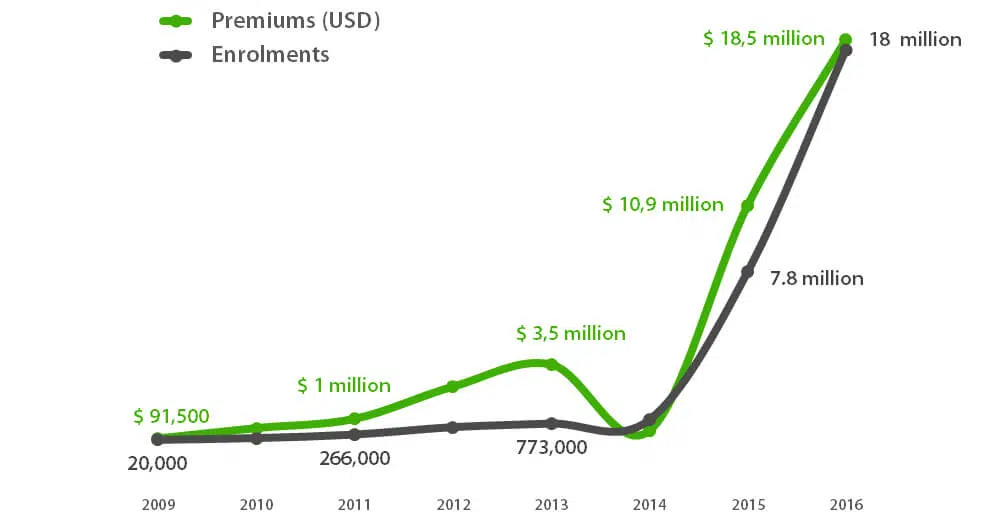

After two days in the field and seven days of building, the teams had an exact view on what to offer and are now gearing up for the long haul. Like the example from Pioneer insurance shows below, the road can be long, but the rewards are worth it.

Thanks to the following organizations and people for teaming up with us to make this happen:

- Microinsurance Master

- Access to Finance Rwanda

- AB Consultants

- MicroSave Consulting (MSC)

- Lemmy Manje, international development consultant

The day-to-day planning of our project in Rwanda

We started the week with a refresh of the human-centred design (HCD) method and how it links to Lean Startup. From there we went on to reframe the research the teams had already done to turn it into something tangible and usable. CGAP shared their tools, which are tailored to the microfinance sector. (check ‘m out here!) They helped the teams fine tune some of their interview insights and turn them into design principles, and to define the main risks each target group faced and how to overcome them.

We started the day with our signature brainstorm cards but used additional brainstorm cards designed especially for the specific market we were addressing. (More on that, coming soon…). We continued with rule breaking and opposite thinking. The goal was to look at regular insurance and turn some aspects of it on its head. In regular insurance, you want low frequencies and high claim values (houses burning down, car crashes, etc). But microinsurance is more successful when the claims are frequent and actually serve as proof of value, as well as the added marketing value for those who are uninsured to see that it works. One of the problems to solve is proving the right to a claim. This needs to be as simple as possible. We worked on the customer journey to ideate on what to do to simplify, upgrade or remove unwanted features.

First, the teams looked at the risky assumptions of their idea, determined where their customer knowledge was lacking, and addressed technical questions on feasibility. We made some back-of-the-envelope calculations to determine whether it could become a sustainable business and then pivoted and adapted ideas. Based on these considerations, we defined a way forward deciding what we would test and with which prototypes.

Looking at our interview notes, recordings, and transcripts to glean insights from them, we were able to see patterns emerge of what our target group wanted and needed. The teams updated their concepts by adding features, removing them, radically rethinking the claims management model, etc. They then re-examined their business models to patch them up, investigate new partnership models, such as bundling, which is how microinsurance breaks open a nascent market. Many cases apply insurance on top of what already exists, such as purchases that are already being made, and then up-sell (ex. Tigo, Bima). We identified the new most important assumptions and updated existing prototypes or created entirely new ones. The teams were ready to hit the road once again. The motto was: “If you’re not surprised, you’re doing it wrong.” Participants had gotten a glimpse of the customer’s life and couldn’t wait to get back out on the streets to learn more.

All teams had to pitch to Access to Finance Rwanda (AFR), the funder and instigator of the project, as well as some key experts in the industry. To do this, the teams determined their goal, the strategy they would use, and what to say. They mapped out what needed to be included in the presentation, plus the three most important messages to streamline the pitch. The storyline had to have an engaging story arc with presentation materials to support the narrative. The teams had a pitch dry run with us on Feb. 8 and we guided them further for their pitch on March 8 for further funding.

Inclusive Innovation can help people in need, while also offering growth opportunities.

If you want to scale to the underserved masses in your region, get in touch!