Imagine you are in a taxi (or Grab or Gojek car). When you try to make a conversation with the driver, he responds by giving you stock tips. Unless your driver’s name is Peter Lim, you know you are too late to the party. The same goes for stagflation and recession. By the time everybody talks about them, they are already self-fulfilling prophecies. And nearly every leading company already has strategies and tactics for weathering these tough times.

This is the moment to get ahead of the crowd with business designs and innovation plans that position your company not just for the macroeconomic adversities that everyone now expects but also for when those storms have passed. Research has repeatedly shown that winners have outperformed losers by especially large margins during and after periods of economic disruption. While these companies were attentive to costs, they also looked beyond cost. The biggest winners focused more strategically on making their company future-proof – responding to the near-term challenges but also planning and innovating for what might lie further ahead.

There may be less time to prepare for the post-stagflation and post-recession future than you think. Central Banks are aggressively raising rates, which will at least reduce demand-side inflationary pressures. In 2011, international economists reported that the average duration of roughly 250 recessions in advanced economies and EMDEs since 1960 had been about one year. Similarly, according to the World Bank, there were four global recessions in the seventy years after 1950 (1975, 1982, 1991, and 2009), each lasting about a year. But with so much of modern life, economic cycles may be speeding up. The most recent recession (2020) in the United States was the shortest ever there – lasting just two months.

What you probably shouldn't do

(even if it seems to be working now)

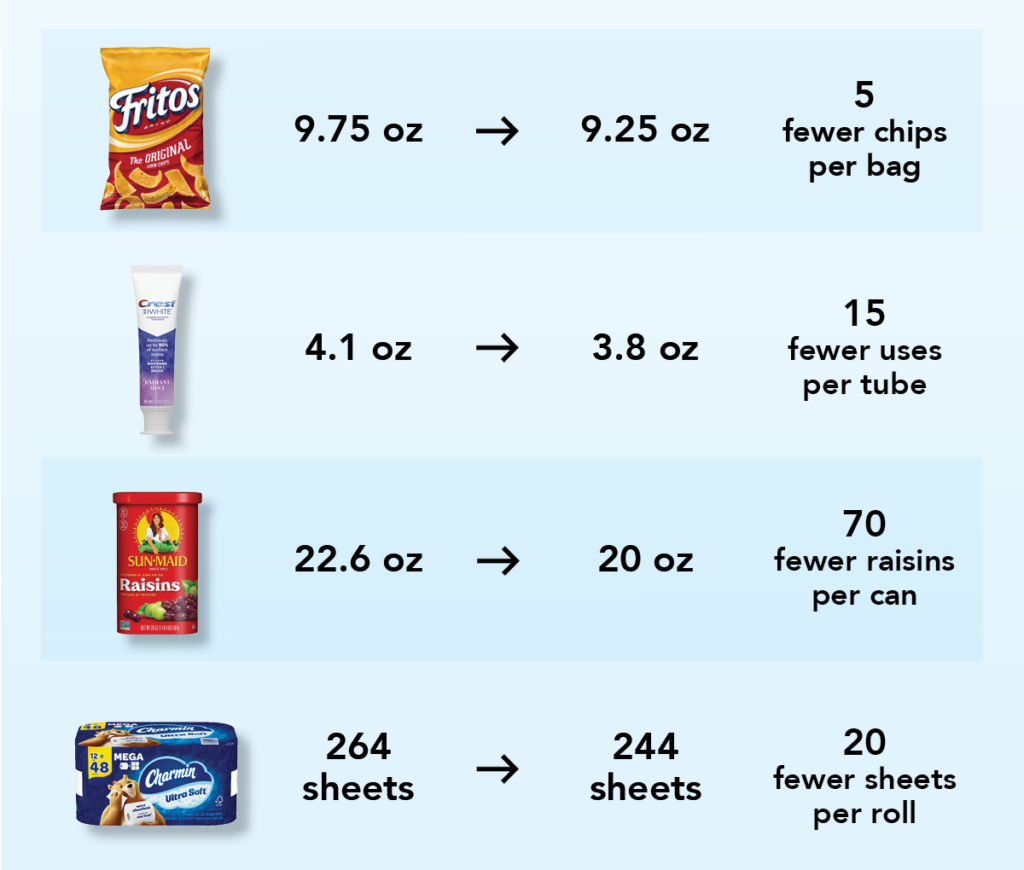

Inflation presents a great opportunity for companies to realign their prices. When all prices are rising, consumers and other buyers can lose track of how much is reasonable to pay. The temptation is to simply raise prices across the board and as much as possible, without much explanation to buyers regarding how those new higher prices were determined.

But across-the-board, non-transparent price increases may sometimes backfire in times of stagflation. With stagflation, consumers may be more price sensitive than usual and more prepared to reduce their consumption of ‘nonessentials’. Meanwhile, B2B customers, beset by their other rising costs (and also sometimes less favorable foreign exchange rates) may be even less open than usual to renegotiating prices with their suppliers.

And even if this traditional inflation-time strategy drives up profits now, will you win with it in the long run? Raising your prices this way may reduce customer loyalty, which may be difficult ever to regain.

Let’s say your company produces Belgian waffles, and enough people want to buy them that you can charge $3 each even though they cost only $1 to produce. In better times, that might allow you to invest in another waffle iron so you can make more waffles — perhaps so many that you can lower the price to $2 and sell enough that your net income still goes up.

But what if there’s a waiting list for new waffle irons because the waffle iron factory in China is shut down due to a COVID lockdown? You can’t make more waffles yet, but their popularity has risen to the point where you would charge $5. People might have started buying crepes instead, but the current supply chain problems make all kinds of similar products hard to find. In that situation, you make a tidy margin without doing much work.

But now, at $5, many of your consumers, including possibly many of your most loyal consumers, the ones who might be evangelists for your waffles, can no longer afford to buy them. Some of them may learn they like other foods more, or perhaps change their habits so they eat waffles only on special occasions. These new preferences and behaviors may persist long after the supply chains have returned to normal, reducing the chance that you’ll ever be able to sell your waffles at the scale you once hoped for, even at $2.

Apart from just raising prices as much as you can (“greedflation”), there are other traditional inflation-time strategies that can be counterproductive if executed indiscriminately:

Expect your employees to work harder without full cost-of-living raises.

In inflationary times, companies effectively cut salaries when they don’t provide pay raises that keep up with the rising cost of living. They can also try to boost per-employee productivity by not replacing employees when they leave and asking those that remain to pick up the slack. During periods of high unemployment, these tactics can work because the employees that remain don’t feel that they have anywhere else to go. But they, too, can backfire if implemented without a corresponding strategy for recruiting and retaining essential personnel.

The pandemic has made already-difficult working conditions even more daunting, so more of them are leaving those professions entirely – sometimes even if they don’t have another job lined up! Fewer people may end up deciding to join those professions, so the pipeline for replacements gets smaller as well. These decisions may well lead to staffing shortages far into the future.

Work from home in exchange for lower raises

In recent years, some employees have been willing to take lower salary increases in exchange for permission to work remotely. Especially during the pandemic, fewer people coming to the office have also created opportunities to reduce office overheads. But once remote work becomes a standard option in many companies, such employees may treat it as a right rather than a privilege. In the Netherlands, there is actually a legal right to work from home, as of July 2022.

Last year a global workforce study found that 64% of workers surveyed in Australia, China, India and Singapore would consider leaving their jobs if required to return full-time to the workplace (with younger workers much more likely to do so than older ones). So offering a remote option may no longer be regarded as enough of a perk to give up full raises. And once more companies offer such flexibility, those that want to hire and retain top talent may have to pay a full price, or risk losing that talent.

Reduce labor costs by perpetually buying new equipment

When labor costs are rising, it makes sense to look at ways to increase automation, which typically means buying new equipment. But in a variety of industries where large and expensive assets still reign, continuously buying new parts can become unsustainable. At the same time, E-commerce will not slow down, so wear and tear on equipment may become even more of an issue.

Pathways to productive innovation

So how can we continue to innovate business models in times of recession without unnecessarily compromising relationships with customers and employees? What sort of moats can be built, with modest investments, to make sure that you hold your clients and talented employees with you and they don’t go somewhere else? And how should you structure your innovation investments so that your company is well-prepared to leap-frog the competition when boom times come again?

Here are some approaches that we have seen succeed, and some that are promising but still cutting-edge:

1. Improve customer and work experiences (and secure long-term loyalty)

Expand channel offerings:

Grab brands itself as “The Everyday Everything App”. Along with Amazon, it continues to demonstrate how channel loyalty can trump brand loyalty. Grab’s cross-product innovations – which encompass grocery transport, shopping, finance, health insurance and telehealth, taxis and buses, hotels, tickets and experiences, and more – are well suited to recessionary times when consumers may not have as much cash on hand to spend as much as they’d like. (For instance, Grab offers food delivery for one penny, but only if you pay that penny through their finance program.) But of course the channel loyalty the company continues to build is likely to pay even larger dividends once economies recover and consumers have more to spend (and are ready to pay higher prices).

Not every company can be Grab, but many of them could benefit by expanding their channels in ways that appeal to customers who want to save money now, and will likely have more to spend in the future. Your main business model may remain more or less the same, but can you identify additional customer problems that you can solve for them?

Channel experiences

As Shopee and Lazada have demonstrated, one way to strengthen your consumer channels is to invest in experiences (e.g., gamifying the search for deals in your virtual store). Adding (the right sort of) friction to the brand experience can create opportunities for impulse purchasing – similar to the wait on a traditional supermarket check-out line, during which you are tempted by sugary treats. Done well, these experiences can boost brand loyalty as well as immediate sales.

Invest in the future of work: Many companies are now saving money on office space, because more of their employees are working remotely. They typically invest some of that savings in providing employees with allowances for coworking spaces, home-office equipment, and other productivity tools. But, with an eye to recruitment and retention at times when both personal and corporate budgets are tight, companies should consider re-directing some of those benefits to simply pay their employees more. Investing in better health (including mental health) benefits can also improve morale and retention.

In some cases, companies should also invest in reinventing (non-virtual) offices to make them more attractive and more productive places to return to work – those infrastructure investments can pay lasting dividends. For example, DBS Bank’s Newton Green office block enables net-zero energy consumption; it is easy for its employees to get to (a stone’s throw from a commuter rail station); and it serves as a beautiful nature conservancy (the building’s abundant exterior foliage provides a haven for threatened native butterfly and bird species).

2. Automate non-value added processes

Not everyone is familiar with the term “non-value-added processes” but we’ve all experienced them – those pervasive, time-consuming, repetitive, yet critical tasks that you and your team dread but can’t avoid. Finding innovative ways to automate those tasks can not only free up work time, it can also raise employee morale and thereby boost retention at a time when your company might not be able to afford more expensive ways of doing so (such as raising pay).

3. Invest in refurbishment/remanufacturing

Instead of perpetually buying new equipment, the better approach will often be to invest in refurbishment/remanufacturing. For example, warehousing technology companies have started evaluating refurbishment of parts of their customers’ machinery. The big challenge for refurbished business models is to evaluate how much manual work will be required per part, which you then offset against the cost of buying new. You also need to consider the logistical cost of returning the goods.

4. Zero-based budgeting for your project portfolio

In recent decades, almost every big company has embraced zero-based budgeting for much of its work. Perhaps the time has come to apply this approach to portfolio management, including for innovation. We’ve worked with global companies that have innovation portfolios that include dozens of projects, but it turns out they’re working on the same thing, for example, in China as they’re doing in Japan. Resources aren’t optimized across parallel projects, and synergies aren’t identified. Maybe in some cases, it would be more cost-effective to focus efforts and resources in one market, getting it done there, and then scaling to the other countries? This approach to portfolio management seems especially important at a time when budgets are tight due to recessionary pressures. It could be built into the budget process so that all innovation investments, globally, are accounted for.

5. Analyze pricing models from a time perspective.

Ever since mobile phone companies had success with subscriptions, companies have tried to find the next big time-based payment model.

Some of these models come with well-documented risks – for instance, the mortgage bubble that burst in the United States in 2008 was an example of what can go wrong with a simple “buy-now-pay-later” model. Both the risks and rewards for such models can be especially great during a recession. Klarna, the Swedish fintech company, is an example of a company that has done very well so far betting on the model’s upside.

One pricing strategy that might make sense now in some situations (as it has historically in real estate) is “make a relatively small down payment now, and a larger series of payments later when you’ll probably be better able to afford them”. And we think there’s probably still room for further innovation with these models and look forward to exploring them with clients.

Especially in times of stagflation and recession, it’s also worth considering models that offer access instead of ownership, such as “rent it when you need it”. Those models have long existed for cars, appliances and travel accommodations, but in recent years they’ve expanded to many other categories. Rent the Runway now has a hotel offering so when you travel, you don’t even have to bring your clothes, you just rent them.

The ultra-wealthy are different, especially in tough times

With consumer products, it’s always important to understand the needs and wants of different segments of the market. During tough times, that might mean focusing on “affordable luxuries” or “affordable nutrition” for those whose finances are tight, with prices set accordingly and in some cases with time-structured approaches to financing. But, historically, periods of stagflation and recession have also provided especially great opportunities for selling products and services to the ultra-wealthy at “only you can afford this” prices and with “pay the full price upfront” payment expectations.

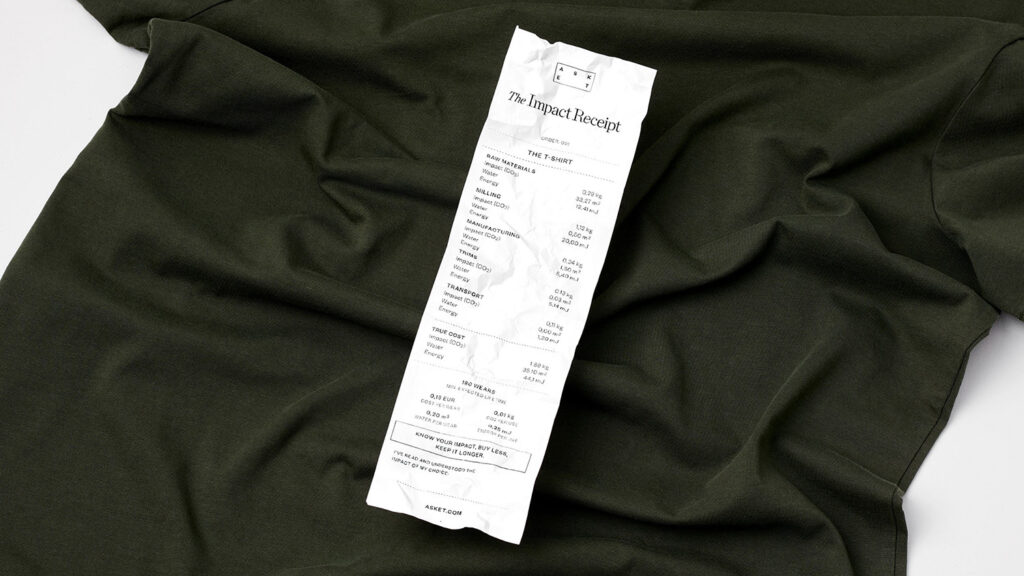

6. Operate in full transparency

Upfront and Asket are examples of consumer businesses that have built their brands on full transparency. This includes not just what’s in their products and how they are made, but also what it costs to make and package and transport them and what are the profit margins. This is a business strategy that may prove exceptionally useful in inflationary times, because these companies will be able to explain price increases to their customers in credible ways that should enable them to dispel suspicions that they are price gouging and may even actually increase brand loyalty. Both consumer and B2B companies might do well to emulate them.

7. Map your ecosystem

Today’s inflationary pressures, and the recession that seems certain to follow, are largely driven from the supply side – by persistent and recurring supply chain failures triggered by pandemic and war. Lower productivity at the port in Shanghai, due to COVID-related staff and driver shortages, continues to mean not enough parts and higher prices for manufacturers in many other countries in the region as well as elsewhere. In APAC, some semiconductor makers do not expect to return to full production capacity for two years, putting a wide range of industries under severe stress.

Not so long ago, the disruptions came on the demand side, as consumers around the world shifted abruptly to low-touch purchasing, products and services to protect themselves from COVID-19. Imports into Asia are still depressed due to COVID-19 lockdowns in China and a general slowdown in China’s housing market.

It seems prudent to assume these will not be the last such disruptions in our time, and that others will arise from the natural disasters that have become more frequent as a result of climate change. For instance, August’s record heat-wave and drought in Sichuan mean that factories in 19 cities and prefectures are being forced to close their doors for five days to reserve electricity for “use by the people.” Heat can often pose particular challenges for manufacturing work, and it will obviously be a long-term problem in many places.

Given such risks, it seems to us more important than ever for each company to understand its ecosystem of suppliers, partners and customers, and the cultural and political contexts in which all of those are embedded. What does your ecosystem look like? Where are the red flags, in the context of stagflation and recession? How will your ecosystem change and expand as you seek to scale?

Mapping your ecosystem can enable you to better focus your innovation efforts to optimize your supply chains, retain your current customers, and plan for a future of success. Use our Ecosystem Mapping tool to get started.

Tackle inflation and the coming recession with your innovation efforts

These seven pathways are a starting point for how you can develop innovation plans and business designs that respond to stagflation, and recession and set you up for success when the storms have passed. This is the moment to get ahead of the crowds.

Let us know how you’re making it happen or how we can get you on the right path.