In November 2022, the US FDA sent a ‘No Questions’ letter to UPSIDE foods effectively certifying that the company’s cultivated chicken is generally regarded as safe (GRAS) to eat. The internet went into a familiar tizzy – with promoters of precision fermentation hailing it as a huge step forward for fixing our broken food system, and skeptics warning about unsolved scaling issues.

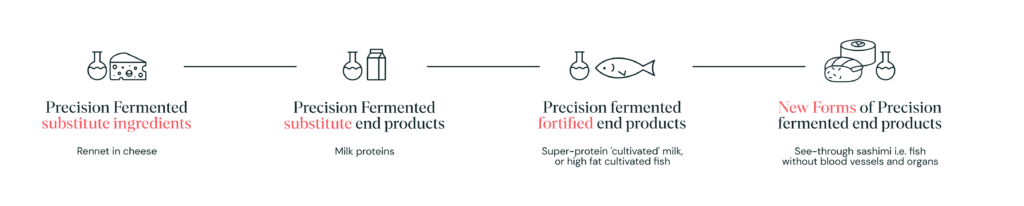

We will focus here on the potential of the cultivated meat industry, going beyond just cultivated ground meat – on scenarios where cultivated whole-cuts become possible to manufacture through precision fermentation.

This may well be the future, but of course it will not be the most immediate future. There are at least three intermediate stages in the evolution of the technology and the market for it that would likely need to happen first – as indicated in the adoption timeline illustrated below (inspired by: Rethink X).

Scale hurdles

The potential environmental and ethical benefits of cultivated meat are, by now, well known.

But the trillion-dollar-question for cultivated meat is “How will it scale?”. There are some very big questions about what that might take , including basic concerns about:

- technology and engineering: Can we really even make the kind of meat we want to, outside of the lab?

- materials: Where will we get all the steel (and other resources) to build the hundreds of thousands of litres of bioreactor capacity we will need?

- human capital: How will we build the armies of biotech engineers we will need to power the cultivated meat industry?

To those outside the industry, the questions about technology and engineering might seem the most daunting. The operative phrase in most arguments that temper enthusiasm for precision fermentation is ‘current science isn’t there yet’. But, ‘current science’ in itself seems like an oxymoron of sorts. What’s ‘currently’ possible has been changing fast. Whether it’s the replacement of Fetal Bovine Serum, or the increasing efficiency of bioreactors, or lower costs for growth factors in the culture medium , startups across the globe have been working on solving those problems and continuously redefining what ‘current science’ actually means.

“The cultivated meat industry is at an inflection point as more and more companies shift their focus from R&D to scale-up. As companies start to scale, volume and unit economics will become critical. The conversation is already starting to shift from can we make something to how much can we make and for how cheap.

Health, Environmental & Socio-Economic Hurdles

Even those who are most optimistic about precision fermentation have to admit that there are still so many things about the technology (and the products it might make possible) that we cannot know yet.

We have little to no knowledge about the possible health and environmental risks of basing our food system on this new way of meat production. There are real risks that companies – pushed by impatient VCs demanding financial returns ‘yesterday’ as well as by some governments seeking competitive advantages for their countries – will cut corners and ignore externalities that could have devastating consequences.

And of course, the disruption of food production systems that have been around for centuries or millennia will pose massive socio-economic challenges. Precision fermentation and other new food production technologies could threaten the livelihoods of hundreds of thousands of cattle farmers and, more generally, the livelihoods of millions farmers worldwide.

Cultivated Meat vs. Regenerative Agriculture: a false choice

Concern for livelihoods is one of the main drivers of support for the Regenerative Agriculture movement, which aims to rejuvenate traditional food production methods, rather than replace them. Regenerative Agriculture could perhaps be, by far, the most sustainable option, from both an environmental and livelihoods perspective, but it would likely require consumers to reduce the amount of meat they eat as a part of their diet.

For the past decades, culture and industry propaganda have deeply ingrained the nutritional superiority of meat in our mindsets. And the reality now is that our current food system has inflated (and is still inflating) world-wide demand for meat to levels that Regenerative Agriculture will not be able to satisfy.

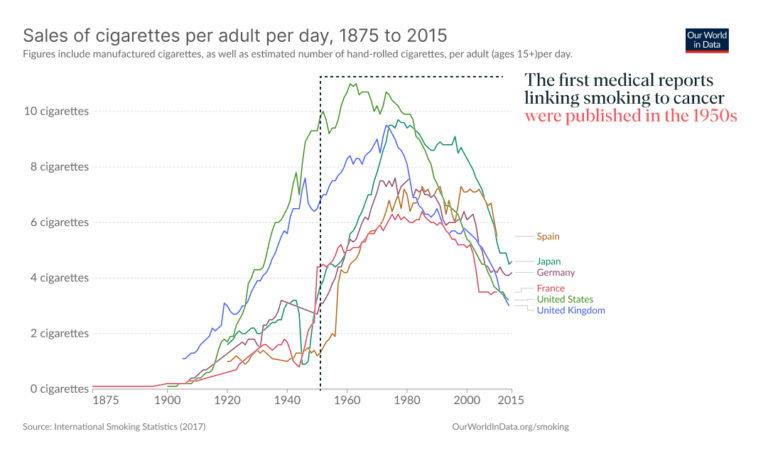

At BOI we work with consumer behavioral change everyday- and know that rituals, habits and the cultural symbolism that surrounds food can take decades to change. It took about 3-4 decades for the much publicized hazards of smoking to make a dent in people’s propensity to smoke- despite many public education campaigns, bans on advertising, aggressive taxation and rising prices of cigarettes.

Consumer hurdles: taste and the ‘yuck factor’

If and how consumers will adopt cultivated meat is also difficult to predict, not least because these products are not on the market yet and that the definitive factor in the consumers’ decision making journey, taste, is just not known.

Some studies have shown that most consumers will likely happily accept cultivated meat (and may even pay more for it) as long as it is positioned the right way – i.e. as tasty as ‘the real thing’. Others have shown that consumers don’t expect cultivated meat to taste much better than plant based varieties, but may try it.

Unlike plant-based meat, cultivated meat IS animal based meat, even though it’s not animal derived meat. We, therefore, think it’s safe to assume that if and when cultivated meat finally hits the mainstream market, it will be identical (if not superior) to the animal derived versions we are accustomed to today.

But some consumers also have health and safety concerns, or are simply repelled by the ‘yuck factor’ of cultivated meat. The ‘yuck factor’ typically refers to the reaction of disgust of the consumer driven by fear of new foods or ‘technologically’ produced foods that they perceive as unnatural (notwithstanding the fact that the meat on our plates today may barely classify as natural to begin with).

Assuming the right taste and price, we think consumer resistance to cultivated meat is likely to come from these fears of adverse impact on health or the ‘yuck’ factor Whether this yuck factor can be counteracted through education and transparency by the cultivated meat industry remains to be seen.

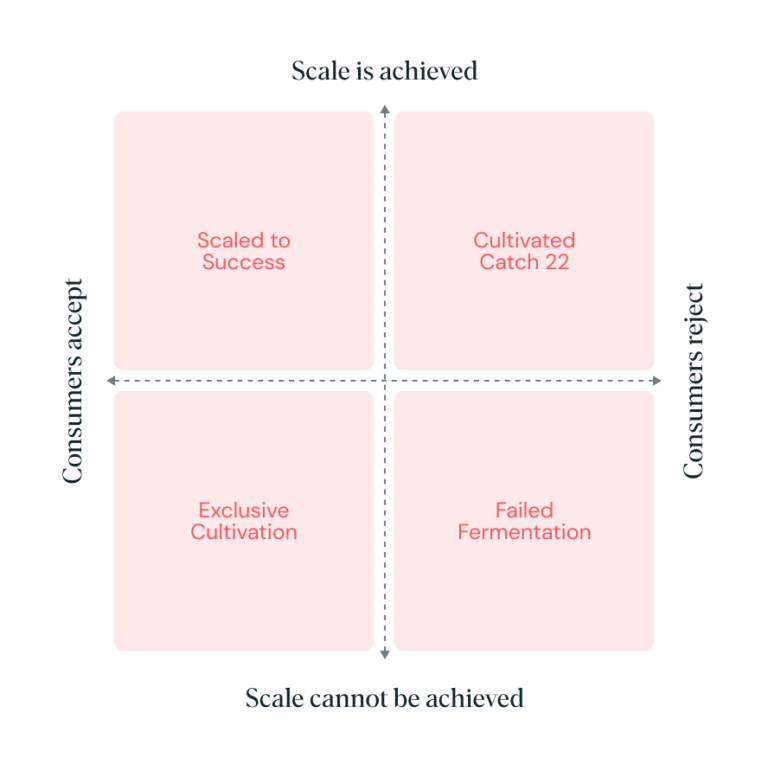

Four scenarios

Failed Fermentation

Despite initial excitement and significant investments in precision fermentation technology for the production of cultivated meat, the industry has not achieved the scale necessary to compete with traditional animal-derived meat. Despite comparable taste, the high cost of cultivated meat products – which can be up to 30% more expensive than traditional meat due to a lack of economies of scale – has deterred consumers.

Governments have defunded related efforts related to cultivated meat as they focus on more pressing issues, such as responding to extreme weather events and other near-term impacts of climate change. Similarly, venture capital has also moved on to other opportunities, leaving many startups in the cultivated meat space with deflated valuations. Some have been forced to close, while others have been consolidated or acquired by existing animal-derived meat companies, who use these investments to improve their image.

As a result, cultivated meat represents a small portion of the overall meat alternatives market, with consumers rejecting the technology due to a lack of trust and misinformation spread on social media about supposed health risks. Mainstream consumers continue to prefer traditional animal-derived meat, despite the worsening environmental crisis. This has entrenched the current meat value chain, and as a result climate catastrophe seems more likely.

The Cultivated Catch-22: Tasty But Unsafe

In this scenario, precision fermentation technology has proven to be scalable, with the industry on track to meet at least 75% of the world’s meat demand. Governments around the world have accelerated approvals for cultivated meat products and invested in the technology, positioning their countries at the forefront of this promising industry. Startups are producing high-quality products, with some even claiming that their cultivated meat tastes better than wagyu. However, despite the technological advancements, consumers remain hesitant about the safety of these products.

Questions about the safety of these products have led to a lot of confusion and skepticism among the public, similar to the concerns that arose during the approval of COVID vaccines. Conspiracy theories about the safety of cultivated meat have spread on the internet, adding to the public’s apprehension. With supply outpacing demand, unutilized production capacity is hurting startups and their investors.

In their rush to scale, companies and cultivated meat brands have overlooked the importance of consumer education. In order to stabilize this scenario, governments, brands and industry consortiums have implemented measures and campaigns to educate the public on the benefits of this new type of product. Despite the initial instability, other trends and drivers are expected to bolster demand until an equilibrium is reached.

Exclusive Cultivation: Tasty but Unaffordable

The market for cultivated meat products is booming, as consumers eagerly embrace the taste, health, and environmental benefits of the new product. However, despite the high demand, there is not enough cultivated meat to be found. Despite billions of dollars in venture capital investments, the industry has struggled to achieve the necessary scale to meet consumer demand. As a result, the price of cultivated meat has risen dramatically, making it accessible only to the wealthiest 2% of the population.

Cultivated meat has become a status symbol, with Michelin-star chefs developing exclusive dishes using products that are not generally available to the general public. Governments have removed regulatory hurdles to boost the market, but the pace of technological improvements has not kept up with demand. The situation is still unstable , as investors continue to chase as-yet-unrealized profits that might be made through the democratization of cultivated meat and sales at scale.

Scaled to Success: Widely Accepted

*Inspired by the RethinkX report

This is the scenario that most industry participants are planning for. Technology has advanced to the point where scale, enough to serve the majority of the world’s meat demand, is achievable. And consumers cannot get there fast enough.

In this best-case scenario, what is the industry going to look like?

To start to answer this question, let’s look at what’s going to be different once cultivated meat is ascendant:

- The fundamental difference in the way new meat will be produced is that the end product may no longer be as ‘homogenous’ as we know it today. Precision fermentation allows for precise control over the properties of the end product: each cultivated-meat producer can, in theory, produce its own unique type of meat, with a unique flavor profile, texture profile or nutritional profile. This will likely mean customization to an extent that we have not known, opening up opportunities to be creative with new (previously unknown) textures and flavors – opportunities that the many nimble cultivated meat startups will likely grab sooner rather than later.

- One of the most significant changes that precision fermentation brings is the ability to produce meat on a smaller scale. There is no longer a need for giant meat packing plants or slaughterhouses, and it may not even be necessary to produce cultivated meat in large batches, especially considering the cost of production errors. Instead, we may see a multitude of medium-scale production facilities with a much more distributed footprint, dictated by consumer demand rather than raw material supply. The industry will employ a large number of trained workers- upskilled ‘farmers’ responsible for operating the new cultivated meat ‘farms’.

- The know-how or capital related entry barriers that currently serve as protection for the old-school meat producers will be a lot lower with biotech companies leading the charge in the new-meat industry and the corresponding infusion of venture capital investments. There are, already, more than 100 startups playing in this space, each with their own specialization in different aspects of the value chain.

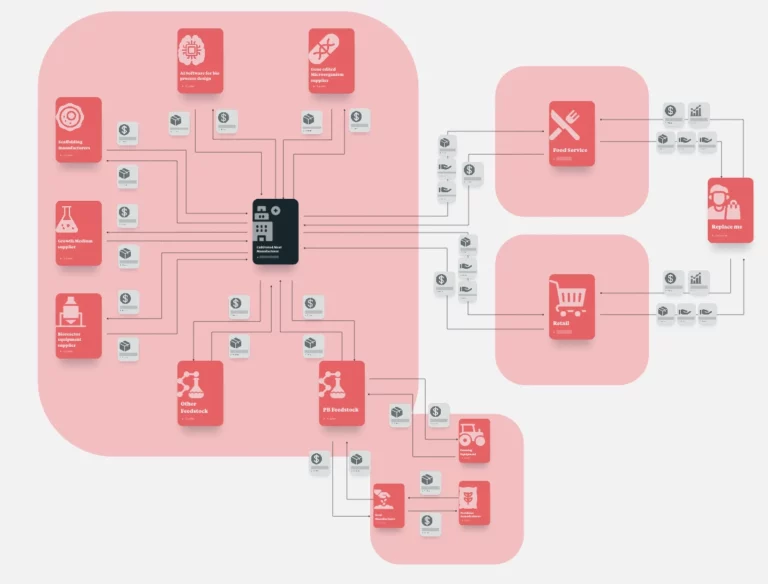

These factors point to a potentially fragmented industry structure with many vertically integrated cultivated meat producers, each with their own brand (and unique cultivated meat molecular recipe) and enough scale to remain viable- this is depicted in the visualization of the cultivated meat ecosystem below.

The ecosystem map of cultivated meat

New roles (and opportunities!) with the convergence of technology and food into one ecosystem

In this best-case scenario for cultivated meat, we foresee a new ecosystem likely replacing the value chains we see in the meat supply chain today. From that ecosystem perspective, we see parallels with the mobile hardware and application industry today, with the following roles emerging:

- The hardware providers : These players manufacture the bioreactors. They will sell their product, but will also have to establish explicit agreements with the back-end and front-end developers (see below) to ensure compatibility.

- The back-end developers: These are synthetic biologists who will write the DNA codes that will eventually be patented. Synthetic biologists that create one of a kind microorganisms- which produce one-of-a-kind meat -will receive royalties anytime their specific ‘recipe’ (e.g. of ‘Wagyu steak’) is produced. There will, probably, be dedicated actors focussed on developing specific microorganisms that produce meats that are not only flavorful, but also offer complex textures.

- The front-end developers : Growth media suppliers provide the nutrients and vitamins necessary for the growth and development of the microorganisms created by the backend developers. The growth media is formulated to meet the specific needs of the cells and support their growth and survival, allowing the cells to thrive and produce the desired end experience for the consumer.

- The App Store owner: There will need to be a virtual marketplace (public or private) where specialized recipes (DNA codes and growth media recipes) can be ‘downloaded’ by the industrial farms which actually cultivate the meat. In an otherwise decentralized and fragmented system, this will be a critical role with respect to food safety. Every time a new recipe of a microorganism is created, it will be deployed on the recipe store -which will need to have an inspection mechanism in place to ensure safety and quality. Given what we have learned in the mobile applications industry, this role is likely to be the orchestrator and ‘rule maker’ for the ecosystem- so perhaps a regulatory/governmental body will be most suitable for the role.

- The analytics providers: With the cultivated meat manufacturing process being sensitive to various parameters, meat farms will require the collection, analysis and process optimization capabilities aided by AI. These process management software providers may be producing their own cultivated meat as well. (We can see early signs of this taking place in the beer industry already.)

So what will you need to do to actively participate in the cultivated meat industry?

Of course every organization can choose a different strategy, based on their current capabilities and priorities today and in the future. So here we simply lay out a few things that future ecosystem participants will be well advised to consider:

- Choose a role in the new value chain and prepare to collaborate: There are multiple roles to play in the new value chain – finding the right one that leverages your strengths will be essential. For the industry to achieve scale, there will need to be focus, specialization and mutually beneficial collaboration across the various parts of the value chain. While having biotechnology capabilities will likely be a necessary condition for starting to participate now, trying to keep all parts of the value chain in-house will take longer, cost more time and capital and spread your resources thin. Start ups are already popping up to serve the upstream needs of (currently non-commercialized) cultivated meat producers. And many others are talking about gaining economies of scale in purchasing equipment in a refreshingly new way:

“So it's going to be economies of scale, it's going to be where 10 of us go to this one provider, a couple of providers and tell them we need all of this equipment for our mass scale, then you will see the prices going down, then you will see economies of scale.”

- The new ‘value chain’ will be less linear and more ecosystem-like in topology – which means understanding your role, and your interlinkages with other ecosystem stakeholders and players will be key to establish yourself as a shaper of the ecosystem, instead of a mere participant.

- Review and start to redefine your business model: To be prepared for an industry landscape that includes distributed supply footprints, fragmentation of roles and players, multiple revenue models, and collaborations with competitors, it’s important to start redefining your views about who your customers are and what your supply chain is. Instead of banking on scale or capital intensive asset footprints to be your competitive ‘moat’, you should be prepared to participate in a more flexible and cooperative industry structure, or one that resembles the sharing economy.

- Consumer proximity and access, regardless of your business model: In an industry where the end product is, theoretically, ‘infinitely customizable’ i.e. meat isn’t just meat, consumers are going to be just as demanding and fickle about the flavor, texture and nutritional profiles of their food as they are about their fashion or music. And the ability to deeply understand, gather and analyze data on and respond to consumer requirements will be a table stake capability.

Concluding thoughts

For the cultivated meat industry to scale to success, there will need to be a lot more innovation, including further improvements in hybrid meat replacement products, improvements in performance of precision fermented single ingredients and many many iterations in cultivated meat production processes.

But for the good of future generations and all life on the planet, we need it to succeed at scale. A simple back-of-the-envelope scenario planning exercise shows a grim forecast if it doesn’t. As fortune favors the prepared, and knowing all too well the hurdles of the innovator’s dilemma, it’s never too early to ‘beef up’ your capabilities for the wave of existential changes that may face the industry sooner than you think.

Get in touch